Tips for optimal loan pipeline management

Introduction

In the intricate journey from a prospective buyer's initial loan application to the final settlement, every mortgage broker or mortgage broking firm knows the multiple processes involved. This complexity requires meticulous management to ensure smooth transitions at each phase, and this is precisely where loan pipeline management comes into play.

Mortgage pipeline management is the process of overseeing and managing the flow of loans from the application stage to the final settlement. It entails tracking each loan's progress, maintaining effective communication with all involved parties, and ensuring a timely, smooth progression towards closing. This functionality is not only about maintaining order; it is the backbone of a thriving mortgage business.

Effective loan pipeline management aids in forecasting revenue, managing risks, enhancing client satisfaction, and ultimately, boosting profitability. In the competitive mortgage market, mastering the art of loan pipeline management can be a significant factor for mortgage brokers and broking firms to differentiate themselves.

At Brokers' BackOffice, a top outsourced loan processing firm, we understand the importance of these processes and are committed to providing insights to help enhance your operations. In this blog post, we will explore the importance of mortgage pipeline management and offer practical tips on optimising it for better operational efficiency and client satisfaction.

Key takeaways

- Implementing structured processes and leveraging modern technologies can greatly enhance efficiency in loan pipeline management.

- Regular training and skill development are crucial to keeping your team updated with evolving market trends, lending regulations, and technologies.

- Outsourcing back-office services allows your team to focus on core tasks such as client service and business development.

- Effective communication with all stakeholders is paramount for customer satisfaction and avoiding misunderstandings.

- Regular reflection on current strategies is necessary to adapt to the ever-evolving dynamics of the mortgage landscape.

What does loan pipeline management entail and what factors affect it?

Loan pipeline management is a holistic approach to managing the entire life cycle of a loan - from the moment a potential homebuyer submits an application, through to underwriting, approval, and finally, settlement.

The mortgage process involves a diverse range of tasks including documentation review, credit and background checks, property appraisal coordination, loan package creation, compliance check, and coordination with lenders, and clients. Managing these processes efficiently is crucial to ensure a smooth transition from one stage to another, thereby reducing the turnaround time, minimising risks, and enhancing client satisfaction.

Several factors affect loan pipeline management, these include:

-

Housing market trends:

The dynamics of the housing market can directly influence the number and type of loan applications. A booming market may result in an influx of applications, requiring more stringent management.

-

Rising interest rates:

Changes in the official cash rate by the Reserve Bank of Australia (RBA) can impact borrower sentiment and the number of loan applications, affecting the volume of loans in the pipeline.

-

Lending regulations:

Regulatory requirements such as the Australian Prudential Regulation Authority (APRA) guidelines influence the loan approval process. Compliance with these regulations is an integral part of managing the mortgage pipeline.

-

Economic factors:

Broader economic indicators such as employment rates, inflation, and GDP growth can impact the borrowing capacity and sentiment of potential homebuyers, thereby affecting the loan pipeline.

-

Technological advancements:

Emerging technology trends and digitisation in the mortgage industry can also significantly impact how the mortgage pipeline is managed. Leveraging modern loan origination systems and automation can streamline the process and increase efficiency.

Recognising these influencing factors and incorporating them into your pipeline management strategy is necessary.

Why is effective loan pipeline management crucial in the mortgage industry?

In the dynamic and ever-changing mortgage industry, the importance of effective loan pipeline management cannot be overstated. While its advantages extend across various dimensions, let's start by understanding the potential consequences of poor loan pipeline management.

Poorly managed loan pipelines can lead to prolonged processing times, increased risks, reduced customer satisfaction, and, ultimately, a negative impact on the bottom line. Inefficient management may result in missed steps or overlooked details, causing delays or even jeopardising loan approvals. The ripple effects can be damaging, with dissatisfied customers potentially sharing their negative experiences, which can harm your reputation in the competitive mortgage industry.

On the other hand, optimal loan pipeline management presents a myriad of benefits:

-

Risk mitigation:

Effective management allows for early identification and resolution of potential issues, reducing the likelihood of loan default or delays in the process. It also ensures compliance with regulatory standards, helping to avoid penalties.

-

Improved profitability:

With more efficient processing, loan closures can occur faster, meaning revenue can be recognised sooner. Plus, efficiency can free up resources, reducing operational costs.

-

Enhanced client satisfaction:

A well-managed loan pipeline translates into a smoother, quicker loan application process, which can significantly improve the borrower's experience. Satisfied clients are more likely to return for future services and recommend your firm to others.

-

Better forecasting:

An effectively managed pipeline provides a clear view of the loans in different stages of processing. This transparency can aid in forecasting revenue and planning resource allocation.

-

Competitive advantage:

In the mortgage market, offering a seamless, swift loan application and approval process can set your firm apart from competitors.

How can you optimise your loan pipeline management?

-

Tip 1: Implement effective tracking systems:

Implementing an effective tracking system is the foundation of efficient loan pipeline management. Various systems offer real-time tracking of a loan's status, which can help manage workloads, identify bottlenecks, and maintain a smooth flow of processes. They provide an overview of where each loan is in the pipeline, who is handling it, and what the next steps are. Consequently, an effective tracking system increases productivity, reduces human error, and enhances operational efficiency.

-

Tip 2: Prioritise accurate data management:

Effective loan pipeline management requires a foundation of accurate, timely data. Inaccurate or outdated information can lead to missteps, increased risk, and delays in loan processing. By ensuring data related to borrowers, loan products, and processes is precise and readily accessible, you will improve operational efficiency, support regulatory compliance, enhance customer service, and facilitate strategic decision-making. Consider employing data management tools to help maintain this data integrity. After all, reliable data is the cornerstone of an efficient loan pipeline.

-

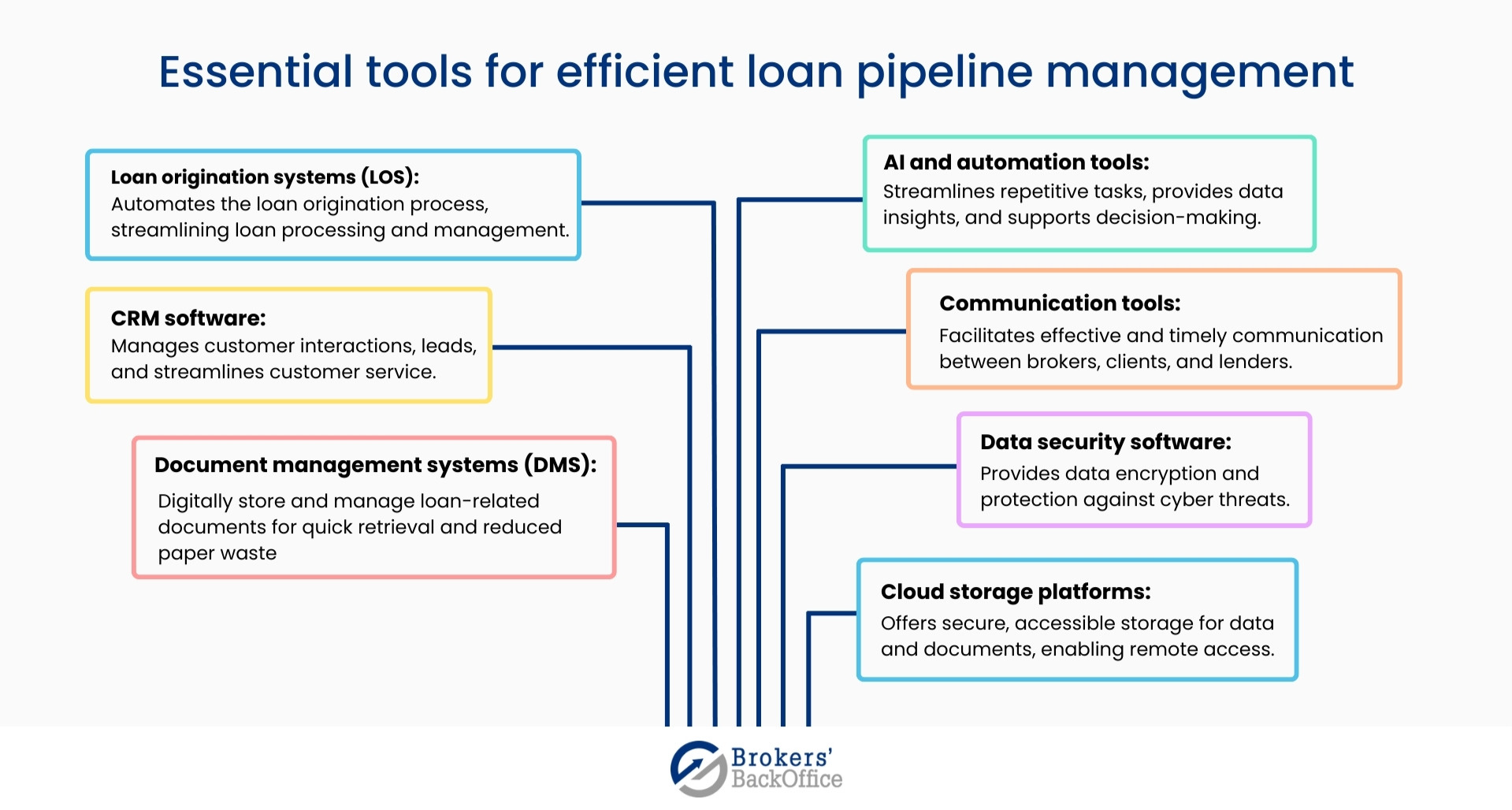

Tip 3: Utilising modern technology and automation:

Modern technology and automation have transformed the mortgage industry, and staying updated with these advancements is vital. Loan origination software and automation tools can streamline the loan process, reduce manual work, minimise errors, and speed up approval times. Popular platforms include:

-

FileInvite:

A platform for requesting and collecting documents from clients securely and efficiently.

-

Zapier:

This platform allows you to integrate and automate workflows across various apps, reducing manual tasks and improving efficiency.

-

Microsoft power automate:

Previously known as Microsoft Flow, this tool automates workflows between your favourite apps and services, enabling data synchronisation and instant notifications.

-

Flowingly.IO:

This software helps you map out, automate, and optimise your processes, making loan pipeline management more streamlined.

-

MailChimp:

An all-in-one marketing platform that helps you manage and communicate with clients, fostering stronger relationships.

-

ClickSend:

This cloud-based service offers fast, secure, and reliable SMS, voice, fax, and more, ensuring efficient communication with clients.

-

Twilio:

A cloud communications platform that enables you to integrate voice, messaging, and video in your loan origination process, enhancing customer interactions.

-

Slack:

A team collaboration tool that streamlines communication and ensures all team members stay updated on the loan pipeline status.

-

Qualia:

A digital real estate closing platform providing a cloud-based solution for managing the closing process.

-

LendingPad:

A comprehensive loan origination system designed to streamline the lending process from origination to closure.

These tools automate repetitive tasks and provide integrated solutions, ensuring accuracy and efficiency in managing your loan pipeline. Harnessing these tools effectively can give you an edge in the competitive mortgage industry.

-

-

Tip 4: Leverage a CRM system:

Utilize a customer relationship management (CRM) system to streamline your loan pipeline. CRM systems, such as MyCRM, Mercury Nexus, Pipedrive, Zoho, or HubSpot, consolidate all borrower information in one accessible location. This not only saves time but also provides a clear visualisation of each borrower's journey. CRM systems can identify any hold-ups in the loan process and help fine-tune your approach. Furthermore, these tools often have built-in automation features, like automatic notifications, which significantly increase the efficiency of loan management.

-

Tip 5: Regular training and skill development:

The mortgage industry is continuously evolving, with changes in market trends, lending regulations, and technologies. Regular training ensures your loan officers stay up-to-date with these changes and can adapt to them effectively. Investing in skill development can enhance team efficiency, ensure regulatory compliance, and improve service quality, thereby contributing to optimal loan pipeline management.

-

Tip 6: Instituting pre-closing reviews for greater efficiency:

Consider introducing pre-closing reviews in your loan management system. These reviews can be seen as the final checklist that happens between 3 and 7 days before closing the loan. This process aims to confirm all essential details such as closing date, location, loan terms, and any last requirements, to ensure a seamless closing process. This proactive strategy can save time and avoid issues at the last moment, reinforcing your commitment to quality and service.

-

Tip 7: Utilising customer surveys for enhanced service:

Implementing customer surveys at different stages of the loan process can provide invaluable insights into your customer service quality. You can survey borrowers 24 hours post-application to ensure everything is working smoothly, mid-process to assess if everything is on track, and 72 hours post-closing to get feedback on your service. These surveys can help you understand and exceed your customers' expectations, thereby improving your service. Additionally, regularly surveying your referral partners can also help you better meet their needs.

-

Tip 8: Adopting proactive communication standards for reduced disruptions:

One efficient way to manage your loan pipeline is by reducing inbound calls. By maintaining regular, proactive communication with all parties involved in the loan process, you can avoid unnecessary disruptions and focus on key tasks. Weekly pipeline review meetings and daily huddles can keep everyone updated, and communicating any loan movement to all stakeholders can ensure transparency and prevent inbound calls.

-

Tip 9: Consistent follow-up for stronger relationships and better business:

Systematic weekly follow-ups with partners can strengthen relationships and optimise growth opportunities. Regular touchpoints with borrowers can help ensure they follow through with the loan process. These follow-ups are integral to building trust and being the chosen mortgage broker when borrowers are ready to apply.

Also, maintaining regular contact with your close customers is essential for retaining them for life. Establishing an annual review process and quarterly calls, supplemented with meaningful marketing touches, can help you leverage your existing customer base for future business and referrals. By adopting these proactive communication standards, you are more likely to provide an excellent customer experience while driving operational efficiency.

-

Tip 10: Outsourcing to increase efficiency:

Outsourcing back-office services can be a game-changer for mortgage broking firms. It allows your team to focus on core tasks like client service and business development while the back-end processes are handled by experts.

If your firm is experiencing increased volume and scalability issues, or if managing the loan pipeline is becoming a significant operational challenge, it is worth considering outsourcing. Look for a service provider that is well-versed in the mortgage industry, offers flexible solutions, and, importantly, understands the unique regulatory landscape of Australia.

At Brokers' BackOffice, we specialise in loan processing and back-office services, helping mortgage brokers and firms streamline their operations and manage their loan pipeline efficiently. Our qualified loan officers stay updated with the latest industry trends, lending regulations, and technologies to deliver top-notch services that can optimise your loan pipeline management.

Quick quiz: Is your loan pipeline management up to the mark?

Choose the answers that best describe your current situation:

How do you currently track the status of loans in your pipeline?

a) We use a manual system, such as spreadsheets.

b) We use basic software tools not specifically designed for mortgage lending.

c) We use a loan origination system or other software specifically designed for tracking loan pipelines.

How often do you update or review data related to loans in your pipeline?

a) As needed, there is no set schedule.

b) Monthly.

c) Weekly or more frequently.

What technology or automation tools do you use to streamline the loan process?

a) We do not use any technology or automation tools.

b) We use some tools, but they aren't fully integrated.

c) We use comprehensive, integrated technology and automation tools.

How do you ensure effective communication with clients, lenders, and other stakeholders?

a) We communicate as needed but lack a structured communication plan.

b) We have some established communication processes but there's room for improvement.

c) We have a structured, regular communication plan for all stakeholders.

Do you regularly invest in training and skill development for your team members?

a) No, we rely on the existing knowledge and skills of our team.

b) Occasionally, when there is a significant change or update.

c) Yes, regular training and development is a core part of our strategy.

Have you considered or are you already outsourcing some of your back-office tasks?

a) No, we handle all tasks in-house.

b) We've considered it but haven't taken steps yet.

c) Yes, we are currently outsourcing some tasks or are in the process of doing so.

Results:

-

Mainly A's:

Your loan pipeline management could benefit from some improvements. Consider leveraging modern technologies and implementing structured processes for better efficiency.

-

Mainly B's:

You are on the right track but there's still room for growth. Investing in advanced tools and regular training could take your operations to the next level.

-

Mainly C's:

Great job! You're employing efficient strategies for managing your loan pipeline. Continue refining your processes to stay ahead in the ever-evolving mortgage landscape.

If you'd like personalised advice to improve your loan pipeline management, don't hesitate to get in touch with our team at Brokers' BackOffice.

Wrapping up

Navigating the complexities of mortgage lending can seem daunting, but by optimising your loan pipeline management, you can turn these challenges into opportunities.

It's time to reflect: Are your current strategies aligning with the evolving dynamics of the mortgage landscape? If there's even a hint of uncertainty, consider this a signal for change.

Don't be hesitant about reaching out to Brokers’ BackOffice for more insights and guidance on refining your loan pipeline management practices or exploring the potential of outsourcing. After all, the goal is to provide a smooth, efficient, and satisfying journey for your clients, which, in turn, boosts the success of your business.

The pathway to enhanced efficiency and greater success is just a step away. Seize the opportunity today and propel your mortgage business to new heights.