The digital revolution: How online lending platforms are reshaping the mortgage industry?

In the dynamic world of mortgage broking, keeping up with the latest industry trends is essential to staying ahead of the game. One of the most significant changes in recent years has been the rise of digital lending platforms, revolutionising how brokers operate and the services they provide to their customers.

Digital lending platforms have transformed the mortgage industry by simplifying loan processing, improving customer experience, and lowering operational costs. By leveraging technology, brokers can access a broader range of loan products and services and provide their customers with faster, more convenient loan processing options.

We at Brokers’ BackOffice, a leading firm specialising in outsourcing for mortgage brokers in Australia, will discuss the benefits of adopting digital mortgage lending platforms, how they are changing the traditional broker-customer relationship, and what mortgage brokers need to know to stay competitive in this new era.

Key takeaways

- Online lending platforms offer borrowers access to potentially lower interest rates and more flexible loan terms.

- Peer-to-peer (P2P) lending, marketplace lending, and online banking are the three main types of digital lending in Australia.

- Each type of platform has its own advantages and disadvantages that should be weighed before making a decision.

- As a mortgage broker, it is important to understand the benefits and risks of different online lending platforms in order to provide a better customer experience.

What does a digital mortgage lending platform mean?

Digital lending platforms are online platforms that allow borrowers to apply for loans and receive funding without needing a physical presence at a bank or lending institution.

These platforms use advanced algorithms and data analysis to assess the customer's creditworthiness and determine the appropriate loan amount and interest rate.

The mortgage applications are entirely online, with borrowers submitting their information through a website or mobile app and receiving a response within minutes or hours.

Overview of the current mortgage industry

The mortgage industry in Australia has seen significant growth in the past five years, with low-interest rates and government incentives driving demand for home loans. According to the Reserve Bank of Australia, as of February 2021, the total outstanding value of housing loans in Australia was over AUD 1.9 trillion, with most loans issued by major banks.

However, the rise of digital mortgage lending platforms has disrupted the traditional lending landscape, with many borrowers turning to these platforms for their home financing needs.

Online loan platforms offer a range of benefits, including faster processing times, a more streamlined application process, and greater transparency. In addition, consumers can access a broader range of lenders and loan products through these platforms, enabling them to find the best mortgage for their needs.

Despite the growth of fintech lending Australia, traditional lending institutions and mortgage brokers still play a significant role in the mortgage industry. These institutions offer more personalised services and can advise borrowers on the best loan products and repayment options.

However, with the increasing popularity of online lending, lenders and brokers must adapt and embrace digital transformation to remain competitive and serve customers better.

How online lending platforms are changing the mortgage business?

Given below are some of the changes brought about by digital mortgage lending:

-

Increased accessibility

In the past, getting mortgage loans involved a lot of documents, meetings with loan officers, and strict requirements that made it difficult for some borrowers to qualify. Digital mortgages have changed all that.

With the rise of online mortgage lenders, the barriers to entry have been significantly lowered. Customers can now apply for a mortgage from the comfort of their own homes using their computers or mobile devices. This convenience has made it easier for people previously excluded from the mortgage market to access financing.

-

Transparency:

These platforms increase transparency, which is achieved through advanced analytics and data processing tools. Through digital platforms, customers can access their credit scores and financial information in real time, giving them greater control over their borrowing options. This increased transparency also enables more accurate refinancing, as customers can quickly and easily identify the best loan options for their needs.

-

Increased competition

One of the most significant ways digital mortgage lending platforms are changing the mortgage sector is by increasing competition. In the past, customers had limited options for choosing mortgage lenders. But with the rise of the online loan process, there are now many different mortgage lenders to choose from.

This has put pressure on conventional financial institutions to offer more competitive rates and terms to remain competitive. As a result, customers can now shop around and find the best deal that meets their specific needs.

-

More flexible loan terms

Digital lending platforms have also brought more flexibility to the mortgage sector. Customers can now choose from various loan terms, including fixed-rate, adjustable-rate, and interest-only loans. This flexibility allows borrowers to tailor their loans to their specific needs and financial situations.

-

Lower risk for lenders

One of the key advantages is that they allow lenders to assess risk more accurately. Digital mortgage lenders use algorithms and machine learning to analyse borrower data and determine their creditworthiness. This reduces the risk of default for lenders and allows them to offer lower interest rates.

-

Increased efficiency

Digital lending platforms also increase efficiency in mortgage services. With automation and technology, lenders can work on the online application process faster and with fewer errors. This reduces the time it takes to approve and fund loans, which can be critical in competitive real estate market segments. Furthermore, the funds are delivered within a matter of days, enabling customers to secure the funding they need in a timely manner, and lenders can improve customer relationships, and reduce operational costs.

-

More affordable mortgages

The lower interest rates offered by digital lending platforms make mortgages more affordable for customers. This can significantly affect the amount of money borrowers pay over the life of their loans. Lower interest rates also make it easier for customers to qualify for more significant loan amounts, which can help them afford more expensive properties.

What is the role of artificial intelligence in digital lending platforms?

Artificial intelligence (AI) is rapidly transforming the financial sector, particularly the lending institutions. Digital lending platforms utilise artificial intelligence (AI) to streamline the lending process, making it more efficient and accurate. In Australia, this has increased competition and accessibility for borrowers, lower interest rates and more flexible loan terms.

One of the primary advantages of using AI in digital loan applications is the increased accuracy of credit risk assessments. It can analyse big data, including credit reports, financial statements, and social media activity, to build a more complete and accurate picture of a customer's creditworthiness. This results in more precise lending decisions and reduces the risk of default.

AI also offers digital solutions to many aspects of the lending process, including mortgage origination, underwriting, and servicing. This leads to faster processing times, allowing customers to receive funds in hours or days rather than weeks or months. Automated systems also reduce the risk of errors or bias, leading to more consistent and fair lending practices.

What are the different types of online lending platforms in Australia?

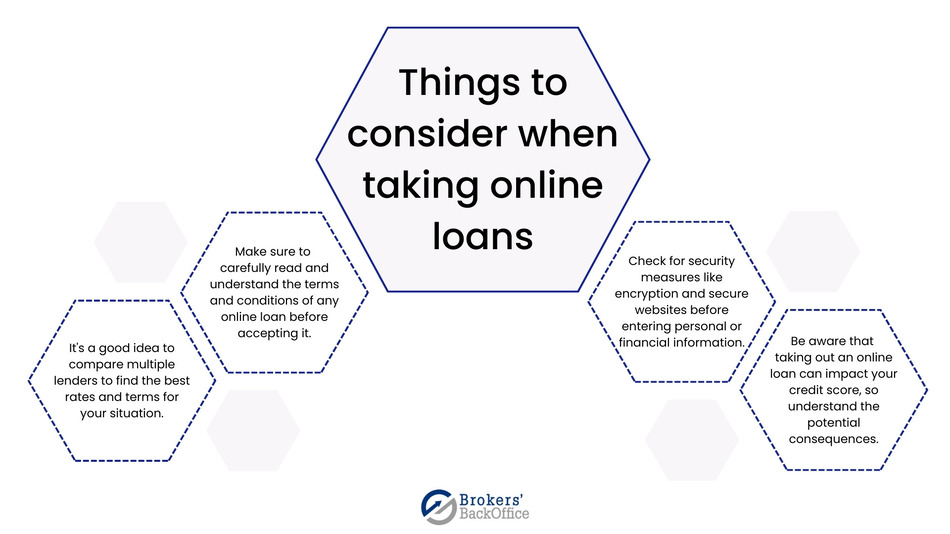

As online lending platforms continue to grow in popularity, it's essential to understand the different types available to borrowers. In Australia, there are three main types of online lending platforms:

-

Peer-to-peer lending platforms

Peer-to-peer (P2P) lending platforms directly connect customers with individual investors. These platforms typically use algorithms to match borrowers with investors based on creditworthiness and risk levels. Some popular P2P lending platforms in Australia include SocietyOne and RateSetter.

-

Advantages:

- Potentially lower interest rates than banks

- More flexible loan terms

- Easy and fast online application process

-

Disadvantages:

- Higher risk for investors than other lending institutions

- Limited regulation may lead to higher default rates

- Limited loan options compared to traditional banks

-

-

Marketplace lending platforms

Marketplace lending platforms work similarly to P2P lending platforms, but borrowers receive funding from a pool of institutional investors instead of individual investors. These platforms also use algorithms to match borrowers with investors based on creditworthiness and risk levels. Examples of marketplace lending platforms in Australia include ThinCats and Moula.

-

Advantages:

- Potentially lower interest rates than traditional banks

- More flexible loan terms

- The fast and easy online application programming interfaces

-

Disadvantages:

- Limited regulation may lead to higher default risk

- Higher fees than P2P lending platforms

- Limited loan options compared to traditional banks

-

-

Online banks

Online banks operate entirely online and offer a range of financial products, including mortgages, personal loans, and savings accounts. They do not have physical branches but offer 24/7 access to accounts through online banking portals. Popular online banks in Australia include ING Direct and UBank.

-

Advantages:

- Potentially lower fees and higher interest rates than traditional banks

- Convenient online account access

- Competitive mortgage rates

-

Disadvantages:

- Limited in-person customer service

- Limited mortgage options compared to conventional banks

- May not offer certain financial products like investment accounts

-

Wrapping up

Digital lending platforms have revolutionised the mortgage sector in Australia. By increasing accessibility, lowering interest rates, and providing faster processing times, these platforms offer numerous benefits to borrowers. Additionally, using artificial intelligence has further improved accuracy and efficiency in the lending process.

As a mortgage broker, it is essential to understand the different types of online lending platforms available and their pros and cons. By doing so, you can advise your clients better and help them make informed decisions.

We specialise in outsourced loan processing and other back-office activities at Brokers' BackOffice. We can help you navigate the complexities of digital lending platforms and provide the support you need to streamline your operations. Contact us today to learn more about our services and how we can assist you.

Table of contents

What does a digital mortgage lending platform mean? Overview of the current mortgage industry How online lending platforms are changing the mortgage business? What is the role of artificial intelligence in digital lending platforms? What are the different types of online lending platforms in Australia? Wrapping up