Pay per application vs dedicated resource: Which outsourcing model suits your brokerage?

Introduction

When it comes to outsourcing loan processing for mortgage brokers, there is no single approach that works for everyone. Each brokerage has different needs, and outsourcing should be shaped to match those needs. The challenge is deciding which model is the best fit.

This blog post will help you analyse the two outsourcing models offered by Brokers’ BackOffice, pay per application and Dedicated Resource, and guide you in deciding which one is the right fit for your brokerage.

Key takeaways

- Outsourcing loan processing is not a one-size-fits-all approach and should match your brokerage’s stage and goals.

- Pay-per-file model offers maximum flexibility by charging only when files are processed.

- A dedicated resource model creates stability by working with the same processor daily.

- The right choice depends on volume, growth plans, budget, and client service priorities.

Outsourcing model 1: pay per application

The pay-per-application model is a flexible outsourcing option that gives you professional loan processing support without the burden of long-term costs.

You pay a set fee for each application, making it easy to align expenses with your actual workload. Every file is processed with accuracy and completed within 24 hours, so your clients receive timely service and you maintain momentum in your pipeline.

Benefits of the pay per application model

Here are the main reasons mortgage brokers find this model valuable in managing their back-office work.

Adaptability to changing volumes: Many brokerages experience peaks and troughs in loan applications. With pay per application, you can bring in extra support during busy times without committing to permanent staff. When business slows, you are not left carrying unnecessary costs.

Low financial risk: Costs are directly tied to the number of files you process. This means there are no ongoing expenses draining your budget during quiet months, making it easier to manage cash flow and keep operations lean.

Access to skilled processors on demand: Even if you only have a single loan file, you can call on trained professionals who understand lender policies, compliance requirements, and aggregator standards. This ensures every file is handled correctly without adding strain to your team.

Support for small and growing brokerages: Smaller practices or brokers in growth phases often do not have the volume to justify full-time staff. pay per application gives them access to professional loan processing when required, without the financial pressure of salaries or lock-in contracts.

Limitations of pay per application model

Like any model, pay per application also has its challenges. You should consider the following limitations before deciding if it is the right fit for your brokerage:

- Higher costs at scale: If your brokerage consistently processes a large number of files every month, paying individually per file can add up. At that stage, a dedicated resource may provide better value for money.

- Less continuity in workflow: Because you are not always working with the same processor, there can be differences in communication style or small variations in the way files are handled. This may occasionally require extra time to review or clarify tasks.

- Limited team integration: Pay per application processors are engaged on a per-task basis rather than as an ongoing part of your team. This means they may not become as familiar with your preferred systems, client expectations, or internal workflows compared to a dedicated resource.

Outsourcing model 2: Dedicated resource

In the dedicated resource model, we assign a fully trained and dedicated loan processing officer to work exclusively as part of your team. You can choose to engage them on a full-time or part-time basis, giving you the flexibility to match support with your brokerage’s workflow and client demands.

Our processors are based in India but securely log in to Sydney-based servers to deliver their work. This approach allows you to benefit from offshore efficiency while enjoying the reassurance of locally managed oversight

Benefits of a dedicated resource model

Below are the key advantages you can expect when working with a dedicated processor for your brokerage:

- Consistency in processing:You work with the same processor every day, which creates reliable communication, familiarity with your files, and smoother workflows.

- Tailored support for your brokerage: A dedicated resource learns your aggregator requirements, lender preferences, and internal systems over time. This creates a customised process that aligns with the way you run your business.

- Efficiency for high volumes: If you handle a steady flow of applications each month, having a dedicated resource is often more cost-effective than paying per file. The fixed monthly arrangement provides the capacity you need without cost fluctuations.

- Closer collaboration with your team: A dedicated processor can join your regular team calls, provide status updates, and work alongside you as if they were part of your in-house staff. This builds better alignment and control.

- Predictable costs for easier planning: With a fixed monthly fee, you can plan your budget with confidence and avoid the expense variations that come with per-file arrangements.

Limitations of a dedicated resource model

The dedicated resource model also comes with certain limitations that you should consider before deciding if it is the right fit for your brokerage:

- Not cost-effective for low volumes: If you only process a small number of applications each month, the fixed monthly fee may outweigh the value you receive. In this case, pay per application could be a better option.

- Less flexibility compared to per-file support: Unlike pay per application, a dedicated arrangement requires an ongoing commitment. This reduces your ability to scale costs down quickly if your pipeline slows.

- Managing leave and coverage: A dedicated processor is entitled to annual leave, sick leave, and public holidays. While backup support can be arranged, you may experience temporary gaps if not planned in advance.

- Initial adjustment period: It can take time for a new resource to fully adapt to your systems, aggregator requirements, and communication style. While this builds long-term value, it may require patience in the early stages.

Scenarios where pay per application works best

Common scenarios where the pay-per-application model is the right fit include:

- Start-up brokerages: If you are just starting out and unsure how many applications you will process each month, pay per application reduces financial risk by tying expenses directly to revenue. You only pay when there is work to be done.

- Seasonal surges: Many brokers face busy periods during property booms or the end of the financial year. Pay per application gives you the ability to scale up instantly during these spikes without committing to extra staff.

- Testing outsourcing for the first time: If you have never outsourced before, pay per application provides a simple, low-risk way to trial the process. You can test how it integrates with your workflow before considering a longer-term arrangement.

What’s included in our outsourced loan processing service?

Whether you choose pay per application or a Dedicated Resource, you receive complete end-to-end support designed to remove the admin burden and keep your pipeline moving. Our service covers every stage of the process, including:

- Document verification: Review and check the accuracy of all client documents.

- CRM and file preparation: Enter client details into your CRM and prepare the application for ApplyOnline submission.

- Lender submission: Upload documents to ApplyOnline and submit the file directly to the lender.

- Lender follow-up: Manage communication with the lender, track progress, and provide regular updates to both you and your clients.

- Progress reporting: Keep you informed at every stage with clear updates on the status of each application.

- Settlement coordination: Support the final steps of the process so loans are completed on time without unnecessary delays.

Scenarios where a dedicated resource works best

Common scenarios where the dedicated resource model is the right fit include:

- Established brokerages: If you consistently process a high number of applications each month, a dedicated resource is more cost-effective than paying per file and provides the capacity you need to manage steady volumes.

- Team integration: When you want a processor to feel like part of your internal team, joining regular calls and following your preferred systems, a dedicated arrangement provides the consistency you are looking for.

- Client-centric brokers: If your service promise relies on quick responses and personalised communication, having the same resource handle your files creates smoother operations and a stronger client experience

How to choose the right model for your brokerage?

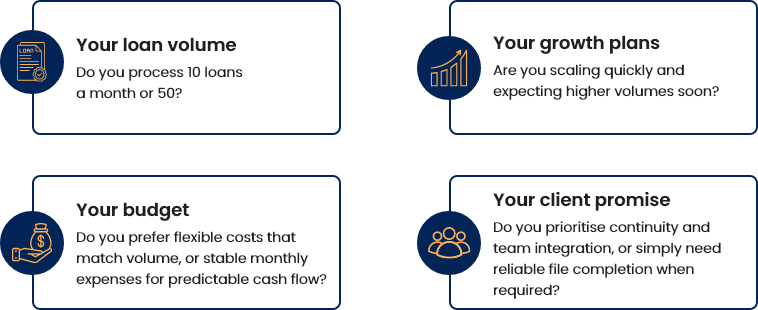

When considering pay per application versus a dedicated Resource, think about:

Often, brokers start with pay per application to manage immediate workload challenges, and as their business grows, they transition to a Dedicated Resource model for long-term stability.

Why choose Brokers’ BackOffice for your loan processing needs?

When it comes to outsourcing loan processing, not all providers are the same. Here are seven reasons mortgage brokers across Australia choose to work with Brokers’ BackOffice:

- Locally managed and connected: We are headquartered in Sydney and our senior management team are active members of the Mortgage & Finance Association of Australia (MFAA). This gives you direct local support, not just offshore assistance.

- Specialised expertise: We are a dedicated loan processing service provider, not a general outsourcing firm. Our processors are trained specifically in mortgage workflows, lender policies, compliance requirements, and aggregator standards, so you get a team that understands the unique demands of your business.

- Comprehensive training and consistency: Every processor goes through structured training via our internal systems and ongoing refresher programs. Guided by detailed checklists and quality controls, this ensures your files are always handled with the same high level of accuracy, no matter who in the team is working on them.

- Flexibility: Our outsourcing models are designed to fit the way you work. With options like pay per application or Dedicated Resource, you can choose the right level of support without lock-in contracts or minimum volumes. This means you scale support up during busy periods and scale down when volumes drop, keeping costs under control.

- Tailored team allocation: We take time to recruit and allocate processors who are the right fit for your brokerage. Our goal is to give you a resource who not only understands loan processing but also matches your preferred style of communication and workflow, creating a smoother partnership.

- Data security: Protecting your clients’ information is at the core of our service. Our IT infrastructure is ISO 27001 certified, which is the international gold standard for information security. From encrypted systems to strict access controls, we follow rigorous practices to keep sensitive data secure.

- Confidentiality: Every engagement is backed by signed non-disclosure agreements, giving you peace of mind that sensitive client information always remains private.

- Insurance protection: Professional indemnity insurance of up to $20 million provides an extra layer of security for your business and your clients.

Final thoughts

While both business models have their pros and cons, mortgage brokers need to choose the option that aligns with their goals and long-term vision. Speaking with our team is the best way to explore how each model works in practice and to decide which approach will bring the greatest value to your brokerage.

Table of contents

Introduction Key takeaways Outsourcing model 1: pay per application Benefits of the pay per application model Limitations of pay per application model Outsourcing model 2: Dedicated resource Benefits of a dedicated resource model Limitations of a dedicated resource model Scenarios where pay per application works best What’s included in our outsourced loan processing service? Scenarios where a dedicated resource works best How to choose the right model for your brokerage? Why choose Brokers’ BackOffice for your loan processing needs? Final thoughts"