The impact of digital disruption on the mortgage industry and loan processing

Introduction

In the ever-evolving financial sector landscape, the term digital disruption has become a recurring theme. You, as a mortgage broker, may wonder, "What is the significance of this trend?" or "How does it affect my operations?" At Brokers' Backoffice, a leading outsourced loan processing firm, we aim to answer these crucial questions.

Digital disruption is not a mere buzzword. It's a genuine revolution in how industries operate, and the mortgage sector is no exception. At Brokers' Backoffice, we understand the pulse of this change and its impact on loan processing services. That's why we reckon it is crucial for our clients to be well-informed and prepared.

In this blog, we will dive into the nitty-gritty of digital disruption and how it is shaking up the mortgage industry. We will explore how this technological shift is impacting not only large financial institutions but also mortgage brokers and broking firms. Whether it is how you interact with your clients, manage your back office tasks, or process your loans, the digital wave is transforming it all.

Key takeaways

- Digital disruption is driving increased efficiency, accessibility, and security in the mortgage industry.

- Big data analytics, automation, AI, and blockchain are transforming loan processing operations.

- Outsourcing to specialised service providers can help smooth out the transition into the digital age.

- Brokers' Backoffice offers comprehensive outsourcing services to help mortgage brokers stay ahead of the digital curve.

What exactly is digital disruption and why should the mortgage companies be aware of it?

Digital disruption refers to the transformative change brought about by emerging technologies and new business models. It embodies a consequential shift that unfolds when novel digital technologies and innovative business models challenge and change the value proposition of existing goods and services.

This phenomenon isn't confined to a single sector; it's a driving force across industries, including the mortgage and loan processing field. To illustrate, smartphones have redefined not only telecommunications but have also instigated changes in areas as diverse as transportation and photography - a perfect demonstration of digital disruption.

In the context of mortgage and loan processing, digital disruption represents a significant shift from traditional operations, moving away from paper forms and in-person transactions to a technology-focused approach. This not only streamlines processes but also reduces errors, enhances customer experience, and sustains competitive relevance in an increasingly digital market.

Understanding digital disruption is critical for mortgage brokers, as it is more than a superficial addition to current practices - it's a complete overhaul of the operational rulebook. Navigating this transformative landscape requires awareness and preparation, making the adoption of these changes an essential factor for sustained growth in our technologically driven world.

How has the mortgage industry evolved over time?

Traditionally, the mortgage market was heavily reliant on paper-based transactions and direct, in-person interactions. The mortgage process was often tedious and time-consuming, with mortgage providers acting as intermediaries, manually processing high-volume documentation for loan approvals.

However, the dawn of the digital age has introduced a transformative shift in this sector. Modern-day customers demand swift, streamlined experiences and personalised services, necessitating a drastic change in the way mortgage lending operates. Coupled with rapid advancements in technologies like artificial intelligence (AI), machine learning (ML), and blockchain, this has propelled the industry towards a more digital-centric approach.

Regulatory changes and increased competition, especially from tech-savvy fintech companies, have also played a significant role in driving this transition. Today, the mortgage industry stands at an intersection of tradition and technology. Adapting to and embracing digital disruption is no longer optional but vital to maintaining relevance in this fast-paced, technology-driven landscape.

How is digital disruption reshaping the mortgage industry?

Digital disruption is dramatically transforming the mortgage industry, leaving an indelible impact on its operations, customer service, and overall efficiency. Let's explore how this metamorphosis is taking shape.

-

Consumer expectations and demands:

The modern-day customer is tech-savvy and accustomed to digital solutions in all areas of life including mortgage lending services. They expect seamless, fast, and personalised services, making digitalisation not just an option but a necessity for the mortgage industry. With the advent of digital disruption, lenders are now able to offer services such as online mortgage applications, real-time loan tracking, and faster pre-approvals, meeting these heightened customer expectations.

-

Improved speed and efficiency:

Gone are the days when borrowers were willing to wait weeks for their mortgage loans to be approved. Digital disruption has enabled the automation of various stages of the mortgage process, dramatically reducing the processing time. Automation processes, for example, can take over repetitive tasks such as data entry, document verification, and preliminary credit checks, leading to significant improvements in speed and efficiency.

-

Increased accuracy and reduced risk:

Manual processes are prone to errors, but digitalisation mitigates this risk. With technologies such as AI and ML, lenders can more accurately assess the creditworthiness of applicants, reducing the likelihood of defaults. Moreover, digital document management systems eliminate the risk of losing or misplacing important customer data.

-

Better customer service:

Customer service is also getting a digital makeover. AI-powered chatbots, for instance, are now providing instant responses to customer queries, making the process more transparent and informative. Borrowers can access information at any time without waiting for business hours or human intervention.

Now, let's look at a few technology disruption examples in the mortgage industry.

-

Embracing the mobility-first attitude:

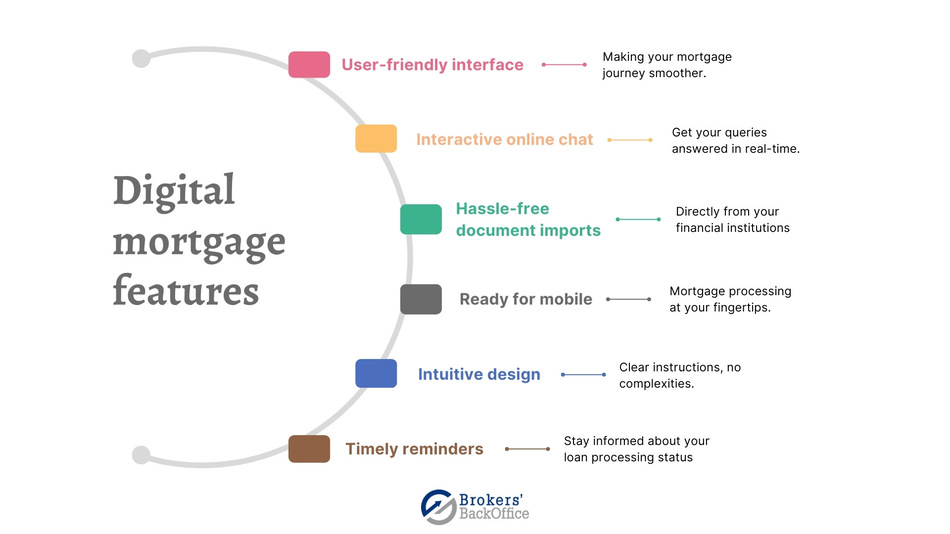

A primary shift ushered in by digital disruption is adopting a mobile-first approach. As borrowers increasingly rely on mobile devices for a wide range of services, the mortgage industry has also begun to prioritise mobile platforms. Mobile apps for mortgage brokers have started to offer functionalities like document uploads, application tracking, and instant updates, vastly improving the customer experience. This mobile-first attitude has introduced convenience and speed, making the loan process more efficient and accessible.

-

Strengthened security provisions:

Digital disruption has not only improved efficiency and accessibility in the mortgage industry, but it has also heightened security measures. With an increase in online transactions and data sharing, securing sensitive information has become paramount. Technologies such as encryption, blockchain, and secure cloud storage have been employed to protect against data breaches and fraud. These advancements are ensuring the confidentiality and integrity of customer data while maintaining compliance with regulatory standards.

-

Big data driving transformations:

Big data is spearheading significant alterations in the mortgage backend. Mortgage firms now leverage data analytics for risk assessment, loan processing, and customer service improvement. By examining large sets of relevant data, brokers can gain valuable insights, predict trends, and make informed decisions. For instance, credit risk assessments are becoming more accurate, and personalised service offerings are now possible. Such data-driven decision-making is not only optimising operations but also significantly enhancing customer satisfaction.

What's next for loan processing in the digital age?

The future of loan processing appears undeniably digital. Emerging technologies, particularly automation, and artificial intelligence (AI), are expected to fundamentally restructure the mortgage industry by revolutionising the loan processing landscape, transforming every step of the journey.

Online applications have streamlined the initial process, enabling borrowers to conveniently submit their requests from anywhere at any time. The integration of data collection tools like FactFind has automated the tedious task of gathering necessary information, eliminating the need for physical paperwork and reducing errors. With cloud-based platforms, the submission of loan documents has become instantaneous, facilitating efficient communication between borrowers, lenders, and other stakeholders.

The introduction of digital signatures has further expedited the process, enabling secure and legally binding agreements to be signed electronically. This end-to-end digital transformation has not only increased the speed and accuracy of loan processing but has also enhanced customer experience by offering a seamless and convenient application journey.

How can outsourcing facilitate the digital transition in the mortgage industry?

As the mortgage industry grapples with the profound effects of digital disruption, it may seem like a Herculean task for brokers and broking firms to stay ahead of the curve. This is where outsourcing, and more specifically, a firm like Brokers' Backoffice, comes into play.

Outsourcing is a strategic tool that can help mortgage brokers navigate the complex terrain of digital disruption. It involves delegating tasks like loan originations or back office activities to external specialised service providers. These providers are equipped with the latest technologies and possess a comprehensive understanding of digital trends and processes. They can manage the digital transition, allowing brokers and broking firms to focus on their core business activities.

Brokers' Backoffice, for instance, can help mortgage brokers transition smoothly into the digital mortgage market. We understand the nuances of digital disruption in the mortgage industry and have the necessary tools to help our clients adapt. We specialise in outsourcing loan processing services, harnessing the power of automation, AI, and ML to ensure our clients can offer a fast, efficient, and customer-friendly service.

Outsourcing loan processing and back office tasks to Brokers' BackOffice can bring several benefits, such as:

-

Advanced technology:

We offer the advantage of having the latest technology tools and solutions at our disposal. With features like online FactFind, automated data collection, verification, and remote signing, we streamline the loan processing and back office tasks, making them more efficient and less time-consuming. This technology-driven approach helps keep up with the digital disruption in the industry, enabling faster and more convenient loan processing.

-

Expertise:

Our firm specialises in mortgage-related services and possesses the necessary expertise in loan processing and back office tasks. We have a team of professionals who are well-versed in the intricacies of the mortgage industry, including regulatory requirements, compliance standards, and best practices. This expertise ensures that loan applications are processed accurately and efficiently, reducing the risk of errors or delays.

-

Cost-effectiveness:

Brokers BackOffice offers two exclusive service models: pay per application and dedicated team member. These flexible options allow mortgage brokers to choose a pricing structure that aligns with their specific needs and budget. By outsourcing loan processing and back office tasks to us, mortgage brokers can potentially reduce costs associated with hiring and training in-house staff, maintaining infrastructure, and managing overhead expenses.

-

Risk management:

Digital transition comes with its share of risks, including data security and regulatory compliance. We are an ISO 27001-certified firm, having the expertise to manage these risks, ensuring a secure and compliant digital transition.

Final note

The digital revolution in the mortgage industry is more than a passing trend; it's the future. Staying ahead in this fast-paced landscape means embracing digital technologies and seeking effective strategies to integrate them into existing business models.

Outsourcing presents an efficient way to navigate this transition, with firms like Brokers' Backoffice offering specialised expertise to streamline operations and manage digital changes.

Don't let digital disruption become a roadblock. Let it be the catalyst for growth and improved service delivery. Reach out to us at Brokers' Backoffice, and let's shape the future of your business in this digital era together.

Table of contents

Key takeaways What exactly is digital disruption and why should the mortgage companies be aware of it? How has the mortgage industry evolved over time? How is digital disruption reshaping the mortgage industry? What's next for loan processing in the digital age? How can outsourcing facilitate the digital transition in the mortgage industry? Final note