Top 5 misconceptions holding brokers back from outsourcing loan processing

Introduction

The global outsourcing services market was valued at USD 3.8 trillion in 2024 and is expected to reach USD 7.11 trillion by 2030. More businesses are turning to outsourcing as it enables them to scale without compromising service quality.

Despite this growing trend, many mortgage brokers are still hesitant to delegate loan processing, which continues to demand a large share of their time and resources. Often, the reluctance isn’t about outsourcing itself, but about outdated views or past experiences that no longer reflect how professional and reliable outsourcing has become.

In this blog, we look at the main barriers that stop brokers from outsourcing and explain the advantages it brings to their operations.

Key takeaways

- Outsourcing is now a strategic advantage for brokers looking to reduce admin and focus on client service.

- More than a quarter of brokers already outsource loan processing, and the number continues to grow.

- Outdated beliefs and past experiences often prevent brokers from exploring modern outsourcing solutions.

- A mortgage-trained team can reduce the time you spend on training and improve efficiency from day one.

- Communication delays are avoidable when your offshore team works in your time zone.

Why does outsourcing make sense for mortgage brokers?

Mortgage broking in Australia is growing rapidly. In the March quarter of 2025, brokers facilitated 76.8% of all new home loans. This means that for every 100 new loans, brokers helped secure nearly 77 of them. It is the highest market share the industry has ever recorded and highlights the vital role brokers play in today’s lending landscape.

But with growth comes new pressures:

- Reclaim hours spent on manual admin

- Stay focused on client relationships and revenue

- Improve turnaround times without expanding your local team

- Build a more scalable and efficient business

This is not just about lowering expenses. It is about running a business that performs better and gives you more control over your time.

Still, many brokers hesitate to outsource because they may be unsure who they’re trusting with their back-end processes.

If you, too, have some misconceptions about loan processing outsourcing, the sections below will help you understand how partnering with Brokers' BackOffice can ease your workload while maintaining high standards of quality, control, and compliance.

Common barriers to outsourcing loan processing and how Brokers' BackOffice makes it easier

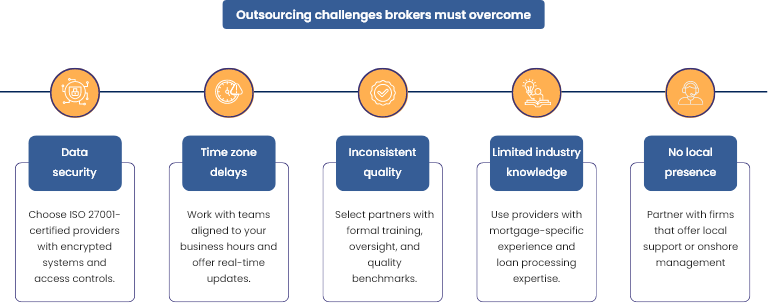

Here are the most frequent barriers that prevent brokers from taking the first step toward outsourcing.

Data security and confidentiality

Outsourcing involves more than just delegating tasks; it means trusting someone with your clients’ most sensitive financial information. When that trust is misplaced, the consequences can be serious.

Some brokers have run into issues after hiring offshore help through low-cost platforms. These informal setups often lack proper structure, reliable systems, and clear accountability. If communication fails or the person suddenly stops responding, there is usually no backup and no protection for client data.

It’s a reminder that not all outsourcing is equal, and research matters.

At Brokers’ BackOffice, we take data security seriously. We are ISO 27001 certified, with systems and processes designed to meet the highest standards of confidentiality. Our safeguards include:

- Encrypted data storage and secure servers

- Access limited to authorised staff using multi-factor authentication

- Regular data backups to prevent loss or corruption

- Mandatory staff training on secure data handling

- Ongoing compliance checks and security audits

With us, you get the support your business needs while maintaining full confidence that your clients’ information is protected with care and professionalism.

Offshore loan processing without data risk

Our blog breaks down the steps you can take to protect client data while working with offshore loan processing partners.

Communication delays and time zone gaps

Many brokers worry that working with an offshore team will lead to delayed responses, missed updates, or communication gaps. When timelines are tight and client expectations are high, even a small delay can cause unnecessary stress.

At Brokers’ BackOffice, we align our operations with your schedule. Our team works during your business hours, so updates and responses happen in real time. Whether you need a quick clarification or an update on a loan file, you will not be left waiting.

We stay in touch through regular Zoom calls and email. If anything needs immediate attention, our Sydney-based managers are here to help. You will always have someone to speak with, and communication will feel just as smooth as working with someone in-house.

Quality and reliability

Many brokers hesitate to outsource because they are unsure whether the quality of work will meet the standards their clients expect. Delays, errors, or tasks needing rework can create more problems than they solve. These issues are common when working with providers who lack proper training, oversight, and accountability.

At Brokers BackOffice, quality is built into everything we do. Team members are carefully trained before taking on any assignments. Their work is monitored, reviewed, and held to high-performance benchmarks from day one.

We are committed to consistency. Every task is approached with attention to detail and delivered with care. There is no need for constant follow-up or corrections. You get support that adds value from the start and frees you to focus on your clients.

Outsourcing should enhance your business, not compromise it. With us, you can rely on a capable and professional team that understands what reliable delivery looks like.

Training and mortgage-specific knowledge

After all, the mortgage industry is filled with specific terminology, processes, and compliance nuances. You might be thinking, “Even if I hire someone offshore, I will still have to spend weeks or months training them. I may as well just do the work myself.”

That might be true for general virtual assistants. But when you work with a provider who understands the mortgage industry, that training burden becomes much lighter.

At Brokers’ BackOffice, team members go through a comprehensive training program focused entirely on loan processing. They learn how to manage documentation, track applications, communicate with lenders, and assist brokers with the day-to-day tasks involved in loan processing.

This preparation means they are ready to support your business without needing to be taught the basics. While every broker has unique preferences and internal systems, the foundation is already in place, so your time is not spent explaining every detail from scratch.

Lack of trust or local connection

Lastly, some brokers hesitate to outsource simply because it feels too far removed. It is easier to trust someone you can meet in person or call when something goes wrong.

That is why having a local presence matters.

Brokers' BackOffice is based in Sydney and supports mortgage brokers across Australia. You work with a team that understands the local market, knows the expectations of the industry, and is available when needed. You are not left waiting or uncertain about who to contact.

You receive consistent support from professionals who stay close to your business and are committed to its success.

Ready to explore the benefits of outsourcing?

Let’s have a quick, no-obligation conversation about how we can support your business securely and professionally.

How to get started with mortgage processing outsourcing?

If you are considering outsourcing for your mortgage business, here are a few steps to make the process smooth and successful.

Clarify what tasks you want to delegate: Start with the low-value, repetitive tasks that take up your time. Examples include document requests, appointment scheduling, file follow-ups, and email management.

Set expectations clearly: Have a defined onboarding process. Create templates, workflows, and communication channels. The clearer your expectations, the easier it is for your assistant to deliver consistent results.

Stay engaged: Outsourcing does not mean disappearing. Regular check-ins, performance feedback, and training updates will keep things running smoothly and help your team improve over time.

Focus on partnership, not just delegation: Treat your virtual assistant as part of your extended team. When they understand your goals and values, their contribution becomes more meaningful and impactful.

Final thoughts

Outsourcing gives brokers the space to improve how their business operates while continuing to focus on client relationships. It helps create a smoother workflow behind the scenes so you can deliver consistent service without feeling overwhelmed.

What makes the difference is partnering with a team that understands your needs and follows through with care and consistency. With the right support, you can keep pace with growing demands and maintain steady progress across your business.

Streamlining your workflow shouldn’t come at the cost of quality. Let’s discuss how we can support your operations with the right systems and expertise in place.

Table of contents

Introduction Key takeaways Why does outsourcing make sense for mortgage brokers? Common barriers to outsourcing loan processing and how Brokers' BackOffice makes it easier? Data security and confidentiality Lack of trust or local connection How to get started with mortgage processing outsourcing? Final words