Common bookkeeping mistakes mortgage brokers make and how to avoid them

Introduction

As a mortgage broker, you spend most of your time chasing deals, looking after clients, and working with lenders. With so much going on, it’s no surprise that bookkeeping often slips down the list. The problem is, when it does, the impact is bigger than you might expect.

Mixing personal and business expenses, forgetting to reconcile commissions, or putting off BAS lodgements are the kinds of mistakes that quickly add up. They can throw off your cash flow, create compliance issues with the ATO, and cost you money in penalties or higher tax bills.

The good news is these problems are avoidable. In this blog post, we’ll walk through eight of the most common bookkeeping mistakes mortgage brokers run into and share simple steps to stay on top of your records.

Key takeaways

- Delaying bookkeeping until BAS or EOFY leads to errors, poor cash flow tracking, and missed decisions.

- Ignoring small expenses means lost deductions and higher tax bills over time.

- Incorrect commission reconciliation creates inflated income figures and compliance risks with the ATO.

- Mixing personal and business expenses makes tax reporting messy and invites ATO scrutiny.

- Relying only on DIY bookkeeping wastes time and often results in penalties, while professional support ensures accuracy.

8 bookkeeping mistakes brokers must avoid

Stop bookkeeping mistakes from haunting your business. We will walk through 8 common bookkeeping issues brokers face and show you how to avoid them.

1. Not devoting enough time to bookkeeping

For many brokers, bookkeeping gets pushed to the bottom of the list until BAS or EOFY deadlines arrive. By then, it’s a scramble to pull receipts, reconcile bank accounts, and fix missing entries.

This rushed approach increases the likelihood of errors and leaves you with inaccurate reports. If your books are not kept up-to-date, you lose the ability to clearly see where your brokerage stands. That means poor cash flow planning, delayed decisions, and unnecessary tax stress.

Pro tip:

The best approach is consistency. Set aside a fixed time each week to update your records and use cloud bookkeeping platforms to make the process faster and easier. Regular attention prevents problems from snowballing.

2. Forgetting to record small purchases

It’s easy to dismiss small expenses like coffee with a referral partner, parking near a lender’s office, or minor software upgrades. But over time, these small purchases add up and impact your taxable income.

If they aren’t logged, you miss deductions, pay more tax, and reduce your profitability. Worse still, if the ATO audits you and you can’t justify your claims, those deductions may be disallowed.

Pro tip:

The simplest solution is to record expenses as they happen. Many brokers snap photos of receipts on their phone and upload them directly into their bookkeeping software. Monthly reviews of bank and card statements also ensure nothing slips through the cracks.

3. Being overly dependent on bookkeeping software

Cloud platforms like Xero and QuickBooks are great tools for managing accounts, but they aren’t flawless. Automated bank feeds can break, duplicate entries may slip through, and incorrect classifications can throw off your financial reports.

If you depend only on automation without any manual checks, your BAS or GST figures could end up wrong, creating compliance problems and poor business decisions.

Pro tip:

Human oversight matters. Run reports regularly and check for unusual transactions. Reconciling accounts every month and scheduling an annual review with a professional bookkeeper will keep your numbers accurate and reliable.

4. Commission reconciliation mistakes mortgage brokers make

For mortgage brokers, commission income is one of the trickiest areas to manage. Payments do not always land on time, clawbacks reduce the amounts you have already received, and trailing commissions may stretch over months or even years. With so many moving parts, relying only on the deposits that appear in your bank account will never give you the full picture.

This approach often creates distortions in your books. You might overstate income and pay more tax than necessary, or understate it and face the risk of compliance issues with the ATO.

For example, if you record a $10,000 commission deposit but fail to account for $2,000 in clawbacks, your tax figures will show inflated income, and you will pay tax on money you never actually kept.

5. Not understanding the difference between cash flow and profit

Many brokers assume that a strong bank balance means the business is profitable. But cash flow and profit are not the same. A busy month of settlements may generate cash flow now, but future clawbacks, supplier payments, or GST obligations could wipe it out.

On the flip side, a temporary dip in cash flow doesn’t always mean the brokerage is unprofitable in the long term. Confusing the two creates a false sense of security and makes it harder to plan for growth.

Pro tip:

Smart brokers prepare detailed monthly and yearly budgets, factoring in both recurring expenses and seasonal fluctuations in income. Regular budget reviews keep spending under control and ensure you're prepared for obligations when they arise.

6. DIY bookkeeping instead of working with specialists

Many brokers try to do everything themselves to save money, including bookkeeping. But DIY often costs more in the long run. Missed entries, late BAS lodgements, or incorrect GST reporting all attract ATO penalties. DIY also takes your time away from core activities like client meetings and loan submissions.

A better option is to choose ATO-compliant bookkeeping services. This approach keeps your BAS lodgements on schedule, ensures accurate GST reporting, and tracks commission income without errors. Brokers gain the assurance that compliance is under control while their time is focused on growing client relationships.

7. Poor budgeting for business expenses

Aggregator fees, lender charges, software subscriptions, and compliance costs can quickly add up. Without a proper budget, brokers often underestimate these expenses and face cash flow problems when bills or tax obligations fall due. A lack of budgeting also prevents you from setting aside reserves for growth or unexpected costs.

Pro tip:

Smart brokers prepare detailed monthly and yearly budgets, factoring in both recurring expenses and seasonal fluctuations in income. Regular budget reviews keep spending under control and ensure you're prepared for obligations when they arise.

8. Mixing personal and business expenses.

Using the same account for groceries and commission deposits may feel convenient, but it causes chaos at BAS and tax time. Blended spending makes it harder to track deductible costs and increases the risk of accidentally claiming personal expenses as business deductions. This is a red flag for the ATO and can trigger unwanted scrutiny.

Pro tip:

The solution is simple: maintain a dedicated business bank account and card. Running all brokerage income and expenses through this account keeps records clean, simplifies ATO compliance for brokers, and makes reporting much easier.

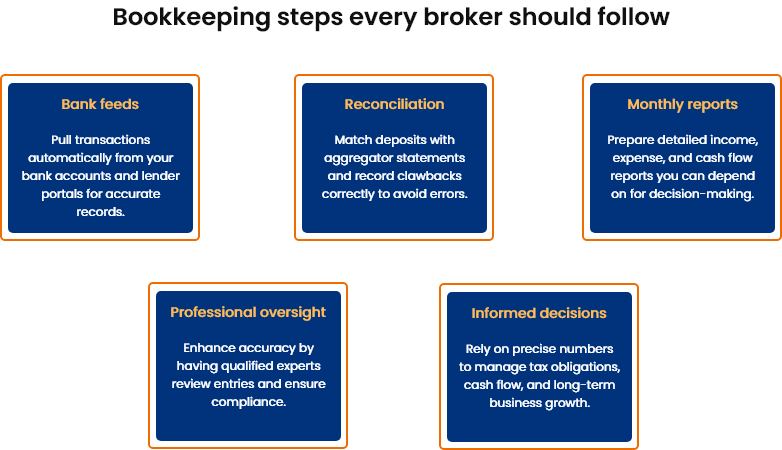

How to improve bookkeeping for your mortgage broking business?

Avoiding mistakes is only part of the picture. To stay ahead, brokers need consistent processes and the right support. This is where working with a dedicated bookkeeping team makes a difference. At CleanSlate, we help brokers by:

- Record every commission and expense with accuracy so nothing is missed.

- Prepare and lodge BAS and GST on time to avoid ATO penalties.

- Reconcile bank accounts and aggregator statements each month for a reliable view of income.

- Manage payroll and super obligations so staff are always looked after.

- Track deductible expenses so you do not pay more tax than necessary.

- Deliver monthly and yearly reports that show cash flow and overall performance.

- Provide secure cloud access so your records are always available.

When you work with us, you gain the peace of mind that your bookkeeping is accurate, compliant, and always accessible through a secure cloud platform at a transparent fixed fee starting from $225 per month (ex GST).

Just like Brokers’ BackOffice loan processing support helps free up time with lenders and clients, partnering with CleanSlate ensures your compliance and reporting stay on track.

FAQs

What are the biggest bookkeeping challenges unique to mortgage brokers?

Unlike many small businesses, brokers deal with irregular commission income, clawbacks, and complex aggregator statements. These unique factors make reconciliation and forecasting more challenging, which is why consistent bookkeeping processes are especially important in the mortgage industry.

How often should bookkeeping reports be reviewed by brokers?

Monthly reviews of cash flow, profit and loss, and balance sheets help maintain accuracy. Regular checks highlight discrepancies early and prevent last-minute stress during BAS or EOFY. Many brokers also find quarterly reviews useful for tracking performance trends and adjusting budgets.

How long should business records and receipts be stored safely?

The ATO requires businesses to keep records for at least five years from the date of lodgement. This rule applies to receipts, invoices, payroll information, and GST documentation. Keeping these records in digital form is often safer and makes them easier to access if the ATO requests them during a review or audit.

For the most up-to-date details on record-keeping obligations, you can visit the official ATO website.

What role does bookkeeping play in succession planning for brokers?

If you ever plan to sell your brokerage or bring in partners, accurate bookkeeping records directly increase the value of your business. Clean financial statements give buyers and lenders confidence in the stability and profitability of your operations, making it easier to negotiate favourable terms.

How does bookkeeping help brokers prepare for seasonal fluctuations?

The mortgage broking industry often experiences busy and quiet periods. Detailed bookkeeping records and forward-looking forecasts reveal these seasonal patterns clearly. This allows you to set aside reserves during peak months and manage expenses effectively during slower periods, reducing financial pressure and keeping the business steady.

Why is real-time bookkeeping becoming more important for brokers?

With the ATO introducing faster reporting systems such as Payday Super, real-time bookkeeping is no longer optional. It ensures that compliance obligations are met on time and provides up-to-date visibility of income, expenses, and cash flow. For brokers, this means quicker decisions, fewer compliance risks, and better control over day-to-day operations.

Final thoughts

As your brokerage expands, it is natural to encounter some of the bookkeeping challenges discussed in this post. The key is to build a solid understanding of bookkeeping practices or engage a professional team.

Partnering with CleanSlate gives you accurate records, timely compliance, and the confidence that potential red flags are addressed before they turn into bigger issues. Get in touch to know more about our bookkeeping services for mortgage brokers. Our team ensures BAS lodgements, tax reporting, and commission reconciliations are accurate every time.