How to cultivate a learning environment in your broking firm?

Introduction

Staying current with industry trends and developments is crucial for mortgage brokers, as it directly impacts the quality of service provided to clients and their business growth.

The mortgage industry is experiencing significant changes, shifting focus from refinancing booms to new customer needs and regulatory adjustments. These changes create a need for brokers who are knowledgeable and adaptable to evolving market conditions.

This blog introduces six innovative methods to foster a culture of continuous learning within mortgage broking firms, aiming to equip brokers with the necessary skills and insights to excel in this transforming environment and meet current and future industry challenges.

Key takeaways

- Continuous learning enhances professionalism, credibility, and reputation in the industry.

- Staying current with market trends and regulations is vital to providing accurate information to clients.

- Online courses and webinars provide flexible, professional development options.

- Seeking mentorship from experienced industry professionals can be highly beneficial.

- Connecting with Brokers' BackOffice can help secure the future success of your mortgage broking business.

Importance of continual learning in mortgage broking firms

Here are the reasons that highlight why continual learning is vital in a broking firm:

-

Staying current with market trends and regulations:

The mortgage market is dynamic, with frequent updates in products and regulations. Continual learning enables brokers to keep up with these changes, ensuring they provide accurate and current information to clients.

-

Enhancing professionalism and credibility:

Brokers who invest in their learning and development are perceived as more professional and credible. This commitment to growth enhances their reputation and distinguishes them from competitors who don't prioritise learning.

-

Expanding knowledge and skillset:

Continuous education allows brokers to broaden their knowledge and skills, better serve their clients, and identify new market opportunities.

-

Increasing earning potential:

Brokers committed to learning and growing can increase their earnings. They can offer more comprehensive services by acquiring new skills and knowledge, leading to higher fees and commissions.

-

Staying competitive:

In a competitive market, brokers who continually learn and grow have a distinct advantage. This proactive approach to learning helps them attract new clients and retain existing ones.

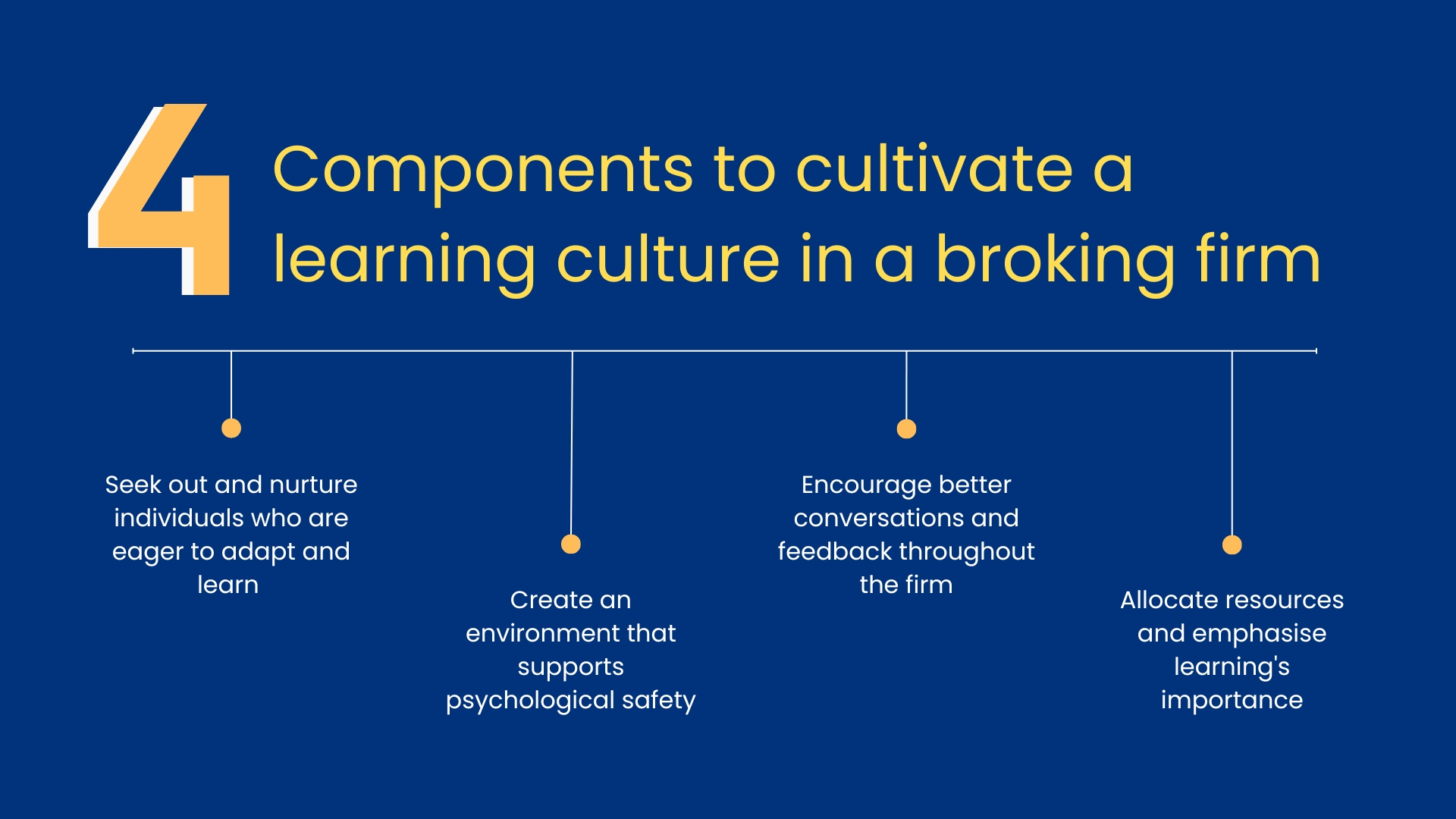

6 proven methods to cultivate a learning environment in a broking firm

Attend industry conferences and workshops:

Participating in industry conferences and workshops is a dynamic way to stay abreast of the latest trends and developments in the mortgage industry. These events are often graced by seasoned professionals and thought leaders whose insights can be invaluable. They provide a platform for interactive learning, covering various topics, from regulatory changes to innovative lending practices.

Moreover, these gatherings are hotspots for networking, offering opportunities to build relationships with peers, mentors, and potential business partners. These events can expose you to new tools and technologies shaping mortgage broking's future.

Read industry-related material:

Dedicating time to reading industry-related materials such as journals, magazines, and online publications is crucial for staying informed and ahead in the mortgage industry. These resources offer a deep dive into various aspects of the field, from market analyses and trend forecasts to success stories and case studies.

Following blogs and social media accounts of industry influencers can provide daily insights and tips. This habit keeps you updated on the evolving landscape and stimulates new ideas and strategies for your practice.

Participate in online courses and webinars:

Online courses and webinars provide a flexible and convenient avenue for professional development in the mortgage industry. They offer various topics, from basic mortgage principles to advanced niche areas, allowing brokers to enhance their knowledge and skills according to their pace and interest.

These digital platforms often feature interactive sessions with industry experts, providing an opportunity for real-time engagement and clarification of doubts. Additionally, many of these courses offer certifications that can add credibility and recognition to your professional profile.

Seek mentorship:

Engaging with a mentor in the mortgage broking industry can be highly beneficial. A mentor with substantial industry experience can provide crucial guidance, advice, and support, particularly in navigating complex or strategic situations. This mentorship offers unique insights and learning opportunities not typically available through conventional educational routes. Additionally, mentors can broaden your professional network, opening doors to new business opportunities and collaborations.

It's also crucial for brokers to seek mentors and trainers accredited by recognised industry bodies such as the Mortgage & Finance Association of Australia (MFAA) and the FBAA. Choosing mentors affiliated with these organisations ensures brokers receive high-quality, relevant training and development tailored to their professional needs.

Participating in role-specific training programs:

Role-specific training programs are tailored to address the unique challenges and requirements of the mortgage industry. These programs enhance loan processing, risk assessment, and customer service skills.

They often combine theoretical knowledge with practical applications, providing a comprehensive learning experience. Such targeted training can significantly improve your proficiency and efficiency in your role, making you more competent and competitive in the market.

Engaging in collaborative learning groups:

Collaborative learning groups offer a platform for mortgage professionals to come together and share knowledge, experiences, and best practices. These groups can be study circles, online forums, or regular meet-ups.

Discussing real-life cases, brainstorming solutions to everyday challenges, and sharing industry news and updates can lead to a deeper and more practical understanding of the field. This collaborative approach fosters a sense of community and collective growth, which is beneficial for personal and professional development.

Wrap up!

It is clear that creating a learning environment is crucial to the success of mortgage broking firms. The ever-changing nature of the industry demands continual learning and adaptation to thrive. Brokers’ BackOffice understands this need and has become a reliable partner for many successful mortgage broking firms.

With our team's specialised training and expertise in handling loan processing and back-office activities, we provide unmatched support throughout the loan process. From preparing applications for broker review to seeing them through to settlement, our outsourced loan processing sservices make us an invaluable asset for brokers looking to create a strong learning culture within their firm.

Connect with Brokers’ BackOffice today and take a significant step towards cultivating a thriving learning environment and securing the future success of your mortgage broking business.