How open banking revolutionised the mortgage industry for brokers and aggregator groups in Australia

Introduction to open banking and its impact on mortgage brokers and aggregator groups

In recent years, the financial services industry has seen a significant shift with the introduction of open banking. This concept, which allows consumers to securely share their financial data with authorised third-party providers, has the potential to revolutionise the mortgage industry for brokers and aggregator groups in Australia.

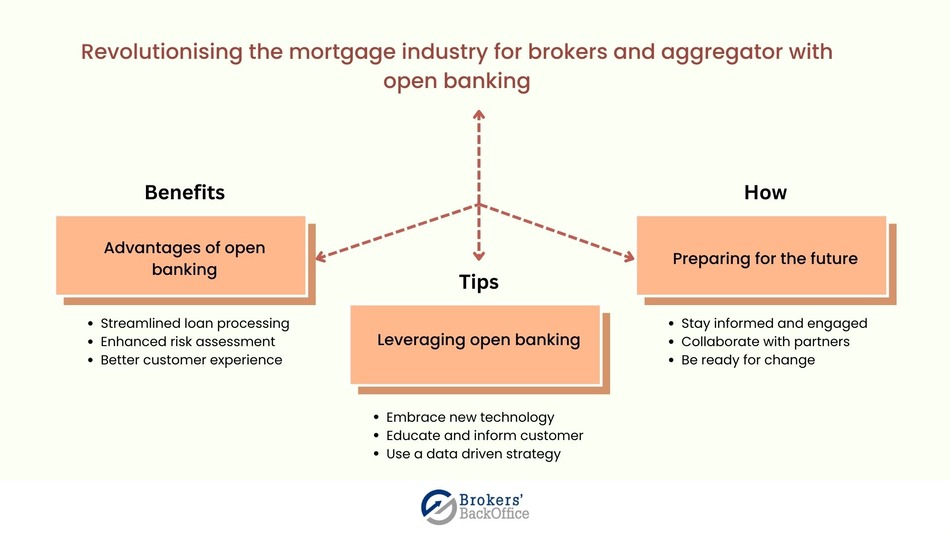

By providing greater access to financial data, open banking has the potential to streamline the loan processing experience, making it more efficient, cost-effective, and customer-centric. In this blog post, we'll explore how open banking impacts mortgage brokers and aggregator groups, discuss its benefits, and provide tips on how to best leverage this new technology.

What is open banking?

Open banking is a global financial services trend that enables customers to share their financial data securely with authorised third-party providers, such as banks, fintech companies, and financial institutions. This is made possible through APIs (Application Programming Interfaces), which allow different software applications to communicate and share data with each other.

Open banking aims to provide customers with increased choice, control, and transparency over their financial data, fostering innovation and competition in the financial services industry.

The benefits of open banking for mortgage brokers and aggregator groups

Open banking offers numerous advantages to mortgage brokers and aggregator groups, including faster loan processing, better risk assessment, and improved customer experiences.

-

Streamlined loan processing

By utilising open banking APIs, mortgage brokers and aggregator groups can access customers' financial data more quickly and efficiently than ever before. This means that the traditional, time-consuming process of collecting and verifying financial documents can be greatly reduced, resulting in faster loan approvals and a more streamlined loan processing experience for both customers and brokers.

-

Enhanced risk assessment

With access to a wider range of customer data, mortgage brokers and aggregator groups can make more informed decisions when assessing credit risk. This enables them to offer a more personalised and accurate assessment of a borrower's financial situation, which can result in better-suited loan products and potentially lower interest rates for customers.

-

Improved customer experiences

Open banking allows mortgage brokers and aggregator groups to provide more tailored and efficient services to their clients. By leveraging financial data, brokers can identify potential borrowing opportunities and offer personalised loan products to meet their customers' unique needs. This not only improves customer satisfaction but also helps to build long-term relationships based on trust and transparency.

How mortgage brokers and aggregator groups can leverage open banking

As open banking becomes more widespread, mortgage brokers and aggregator groups should adopt strategies to take full advantage of its potential.

-

Embrace technological innovation

To stay competitive in the evolving financial landscape, mortgage brokers and aggregator groups must embrace new technologies and invest in digital transformation. This may involve integrating open banking APIs into existing systems, developing custom software solutions, or partnering with fintech companies that specialise in open banking services.

-

Educate and inform customers

As the concept of open banking may still be unfamiliar to many customers, it's essential for brokers and aggregator groups to educate and inform them about its benefits and potential risks. By being transparent and addressing any concerns, customers will feel more confident and secure in sharing their financial data.

-

Develop a data-driven approach

To make the most of open banking, mortgage brokers and aggregator groups should adopt a data-driven approach to their business operations. By analysing customer data, they can identify trends, make better-informed decisions, and offer more personalised and effective loan products. This will not only help to improve customer experiences but also drive business growth and profitability.

-

Ensure data security and compliance

Data security and compliance should be a top priority for mortgage brokers and aggregator groups when implementing open banking. By implementing robust data security measures and maintaining compliance with industry standards, brokers and aggregator groups can build trust with their customers and protect their business reputation.

Preparing for the future of open banking in the mortgage industry

As open banking continues to gain traction in the Australian financial services sector, mortgage brokers and aggregator groups must be proactive in adapting to these changes.

-

Stay informed and engaged

To ensure success in the evolving financial landscape, mortgage brokers and aggregator groups should stay informed about the latest developments in open banking and related technologies. This can involve attending industry conferences, participating in online forums, and engaging with relevant stakeholders to stay abreast of trends and best practices.

-

Collaborate with industry partners

By partnering with fintech companies, banks, and other financial institutions, mortgage brokers and aggregator groups can gain valuable insights and access to cutting-edge open banking solutions. Collaboration can lead to innovative new products and services, helping businesses to stay ahead of the competition and meet the evolving needs of their customers.

-

Be ready for change

As open banking continues to reshape the mortgage industry, brokers and aggregator groups must be prepared to adapt and embrace change. This may involve reevaluating business models, updating internal processes, and investing in staff training to ensure that they remain competitive and relevant in the rapidly evolving financial landscape.

Conclusion

Open banking has the potential to significantly impact the mortgage industry for brokers and aggregator groups in Australia. By providing greater access to financial data, this technology offers numerous benefits, including streamlined loan processing, enhanced risk assessment, and improved customer experiences. To leverage these advantages, mortgage brokers and aggregator groups should embrace technological innovation, educate and inform their customers, develop a data-driven approach, and ensure data security and compliance.

By staying informed, collaborating with industry partners, and being ready for change, brokers and aggregator groups can successfully navigate the open banking landscape and seize new opportunities for growth and success in the mortgage industry.

Table of contents

Introduction to open banking and its impact on mortgage brokers and aggregator groups What is open banking? The benefits of open banking for mortgage brokers and aggregator groups How mortgage brokers and aggregator groups can leverage open banking Preparing for the future of open banking in the mortgage industry Conclusion