The 5 C’s of Mortgage Post-Closing Every Broker Should Know

Introduction

Many brokers focus heavily on getting the loan approved and closed, but what happens after that often gets overlooked. Post-closing is not just a formality. It plays a vital role in ensuring loan quality, investor trust, and long-term business sustainability. Incomplete documents, missing signatures, or slow follow-ups can lead to funding delays, penalties, and reputational damage.

As the lending environment becomes more rigorous, brokers need to understand what truly matters once the loan is closed. A strong post-closing process is not just about ticking boxes. It is about maintaining precision, accountability, and consistency. In this blog, we explore the 5 C’s of mortgage post-closing that every broker should know and implement.

Key takeaways

- A lack of capacity can cause loan backlogs that delay funding and disrupt cash flow.

- Outsourcing teams can help clear post-closing backlogs and keep loan pipelines flowing smoothly.

- Manual processes create errors; automation brings control, consistency, and better visibility across tasks.

- RPA and AI tools improve accuracy by flagging missing documents and adapting to investor rules.

- Strong compliance processes are vital to avoid penalties, buybacks, and investor dissatisfaction.

- Real-time tracking and clear task ownership reduce confusion and help teams work more efficiently.

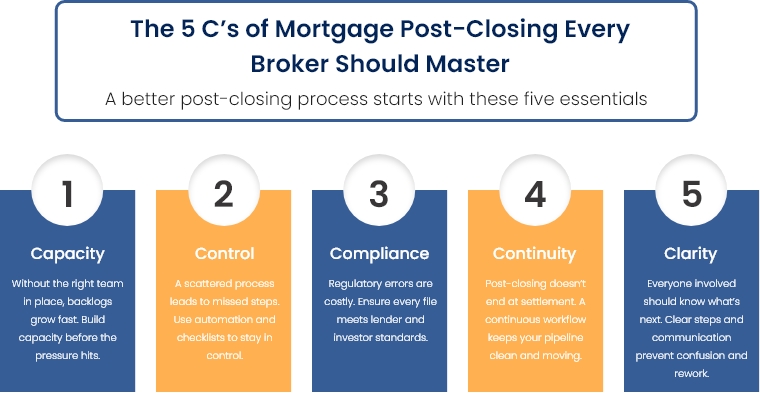

Mortgage Post-Closing: The 5 C’s every broker should master

Here are five key areas that define an effective mortgage post-closing process, helping brokers reduce delays, meet compliance standards, and maintain investor confidence:

Capacity:

The capacity to support loan volume is the cornerstone of an effective mortgage post-closing operation. When post-closing teams are under-resourced, backlogs quickly form, especially after market surges.

These delays can snowball, stretching credit line turn-times from days to weeks or even months, ultimately straining liquidity and disrupting cash flow.

Once you fall behind, catching up becomes extremely difficult, particularly as new loans continue pouring in. This is where Mortgage Outsourcing Partners (MOPs) bring real value.

With access to skilled, cost-effective knowledge workers, they can quickly eliminate even large backlogs, including trailing document tasks. Within weeks, what once felt overwhelming becomes manageable, restoring speed and balance to your entire loan pipeline.

Control:

Control in mortgage post-closing isn’t about remembering tasks or juggling sticky notes, it’s about letting automation do the heavy lifting. In the past, processes were driven by memory, handwritten notes, and manual tracking, which often led to inconsistency and delay. Today, digital tools give brokers full oversight by organizing and streamlining every stage of the post-closing process.

Robotic Process Automation (RPA) accurately reviews documents, flags errors, and ensures data consistency across the loan file. Artificial Intelligence adapts workflows based on changing investor or regulatory requirements, removing guesswork from the equation.

With automation handling routine tasks, human expertise is freed to focus on exceptions and decision-making. This shift from reactive, manual work to proactive, tech-driven control transforms post-closing from a bottleneck into a fast, reliable function that protects both timeline and quality.

Compliance:

Post-closing is not just about completing paperwork. It is about meeting strict investor and regulatory standards every single time. A single missing signature or document can result in delays, penalties, or even loan buybacks. To avoid these risks, brokers need strong compliance measures built into their processes.

Automation tools can flag missing items, check for inconsistencies, and ensure files are audit-ready before submission. Outsourced teams trained in compliance protocols can add another layer of assurance by following investor checklists precisely. With reliable compliance systems in place, brokers can move loans forward quickly while reducing exposure to risk.

Are compliance tasks pulling you away from serving clients?

Brokers BackOffice is here to support you with post-closing reviews, so nothing falls through the cracks.

Continuity:

The post-closing process does not end once the loan funds are disbursed. It continues with the collection, verification, and delivery of all trailing documents. Without continuity, delays can occur in final loan settlement, investor delivery, and loan servicing. Many brokers lose visibility after funding, which leads to gaps and missed timelines.

Outsourcing teams, combined with workflow tools, ensure each document is accounted for and followed up until completed. This level of continuity helps maintain investor trust, speeds up the purchase process, and keeps pipelines moving. It also reduces stress for internal teams, who can stay focused on new files.

Clarity:

When post-closing operations lack transparency, confusion and errors increase. Clarity means knowing where every file stands, what tasks are completed, and what is still pending. Without a clear view, teams waste time chasing updates and resolving avoidable issues. Brokers benefit from systems that offer real-time tracking, centralized dashboards, and assigned task ownership.

This visibility allows for quick adjustments, better communication, and fewer surprises. With clarity in place, post-closing becomes easier to manage, deadlines are met more consistently, and investors receive cleaner files. It also creates confidence across the business, knowing that each step is under control and fully visible.

Wrap up

A loan is not complete until the post-closing process is done right. The five pillars—Capacity, Control, Compliance, Continuity, and Clarity—are essential for ensuring accuracy, meeting investor standards, and keeping operations on track. By focusing on these areas, brokers can improve turnaround times, reduce risk, and maintain a steady, reliable pipeline.

Brokers BackOffice partners with mortgage brokers to manage the full loan process and assist with critical administrative tasks. From preparing files to tracking documents and maintaining post-closing accuracy, we provide the support needed to keep your workflow efficient and compliant. Our service is flexible, detail-oriented, and built around the needs of your business.

Let Brokers’ BackOffice handle the process behind the scenes, so you can focus on what matters most—serving your clients and closing more loans.