What are the advantages of external loan processing solutions for mortgage brokers?

Introduction

As a mortgage broker, you understand loan processing is critical to your business. However, with the ever-increasing demands of the industry, handling loan processing and other administrative tasks can take time and effort.

Fortunately, there is a solution that could lighten your workload and free up your time to focus on your clients and grow your business.

We at Brokers’ BackOffice, a Sydney-based outsourced mortgage processing service provider, specialise in providing these solutions to brokers. We are here to share the advantages that could take your business to the next level.

In this blog post, we will explore the advantages of outsourcing loan processing and how it can help you focus on growing your business while we take care of administrative tasks.

Key takeaways

- External loan processing and back-office activities can increase mortgage brokers' efficiency, productivity, and cost savings.

- Mortgage brokers can access advanced technology, specialised knowledge, and skills by partnering with the right outsourcing firm.

- Outsourcing loan servicing procedures can free up time for mortgage brokers to focus on their core functions and drive growth.

- When choosing an outsourcing partner, mortgage brokers should consider experience, technology, compliance, security, and reputation factors.

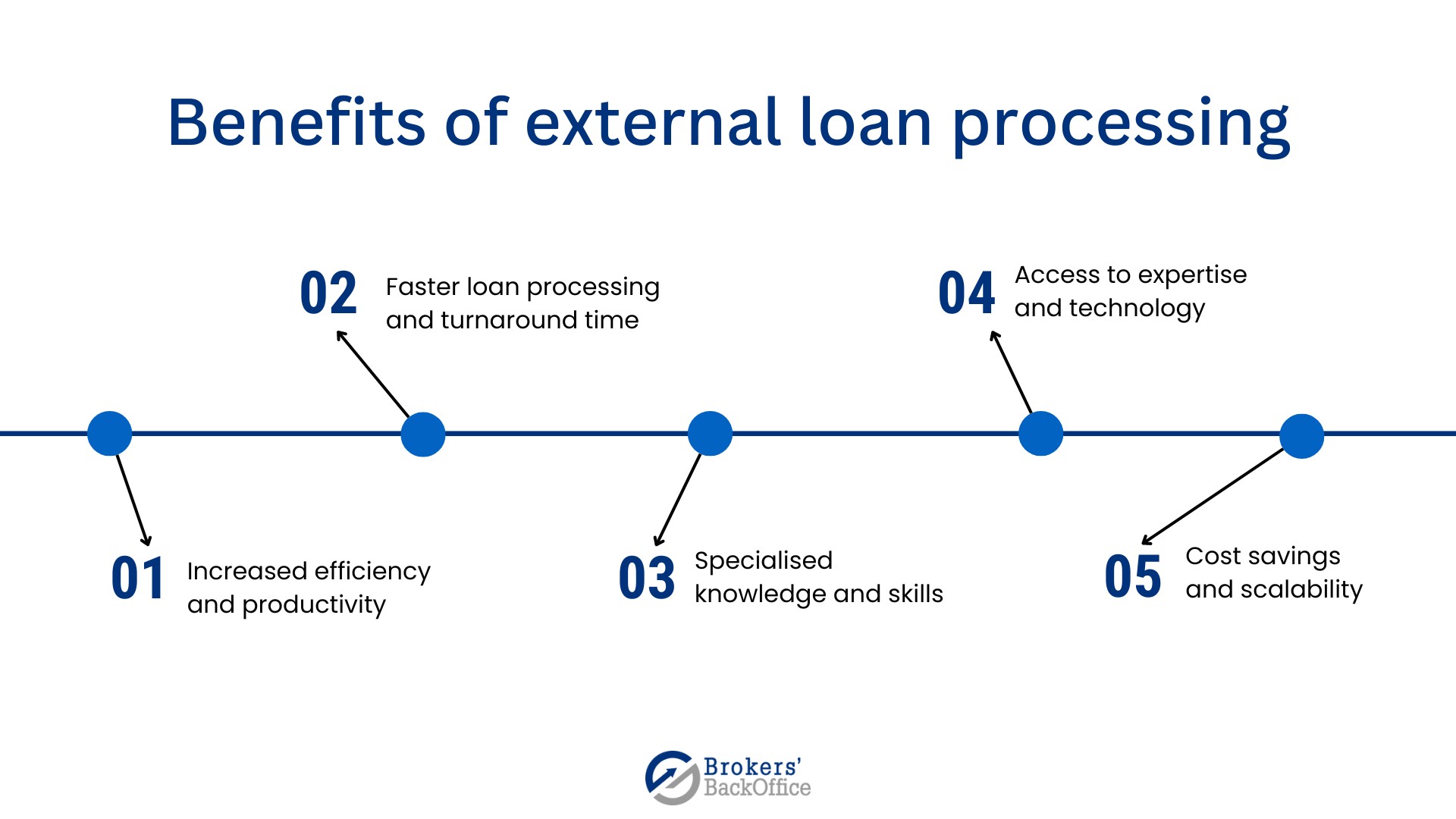

What are the benefits of external loan processing services?

As a mortgage broker, you must know that managing the loan approval process and other back-office tasks can be time-consuming and distracting from your core business functions.

However, outsourcing these activities can provide a range of advantages that can help you focus on growing your business. Here are some benefits of external loan processing solutions for mortgage brokers:

-

Increased efficiency and productivity:

Outsourcing your loan application procedures can increase your efficiency and productivity. By letting a third-party handle your administrative tasks, you can free up your time and resources, allowing you to focus on your core business functions. This can help you to operate more efficiently, get more work done, and ultimately increase your bottom line.

-

Faster loan processing and turnaround times:

At Brokers’ BackOffice, we understand that speed is critical when it comes to the loan-originating process. That's why we offer fast turnaround times through our pay per application services, with a 24-hour processing time. Our streamlined process ensures that loan applications are processed quickly and efficiently, allowing you to provide your clients with faster loan approvals and a better customer experience.

-

Access to expertise and technology:

Outsourcing your loan processing can give you access to a team of experts who are experienced in loan processing and have access to the latest technology and software. At our Sydney-based outsourcing firm, we provide a dedicated team member with access to a support team, including processors, and closers. You can benefit from their knowledge and expertise without investing in the resources.

-

Specialised knowledge and skills:

Outsourcing can also provide you with specialised knowledge and skills that may be lacking in your internal team. You can access a team of experts trained and experienced in handling loan verification processes for various types of loans, including mortgages, home loans, and personal loans.

-

Advanced technology and software:

Outsourcing your loan approval process can also give you access to advanced technology and software to streamline your processes and improve accuracy. At Brokers’ BackOffice, we use the latest software and technology to ensure your loan processing is efficient, accurate, and compliant, including:

- Slack - for increased collaboration and productivity

- Trello - for interactive dashboards

- Quickli - a popular serviceability calculator tool

- Sherlok - comprehensive pricing and repricing tool

- BrokerEngine - mortgage broker software

- FileInvite - for streamlined documents collection and organizing

- Google Drive, OneDrive, Dropbox, and other cloud-based document management systems

-

Cost savings and scalability:

Outsourcing can result in cost savings and scalability. It can help you reduce your overhead costs, such as salaries, benefits, and office space, which can help you save money. Additionally, you can handle larger volumes of loans without worrying about hiring additional staff or investing in expensive equipment. This means you can quickly scale up or down based on demand without worrying about fixed costs.

We specialise in providing external loan processing solutions to help you streamline your processes, increase productivity, and focus on growing your business. Please contact us today to learn more about how we can help you.

What are the common concerns about external service providers?

Some common concerns about external loan support providers are:

-

Security and confidentiality concerns:

One of the main concerns about offshore workers is the security and confidentiality of sensitive borrower information. However, outsourcing firms know these concerns and typically have strict security protocols and procedures to safeguard client data.

These protocols include using secure servers, encryption, and restricting access to client data only to authorised personnel. Additionally, outsourcing firms are typically bound by strict non-disclosure agreements and compliance requirements, which further ensure the confidentiality and security of client data.

Brokers’ BackOffice has implemented various measures to ensure the security and confidentiality of our client's information and address any potential concerns, they include:

- ISO

- Non-disclosure and confidentiality agreement

- Professional indemnity insurance

- Strictly regulated user access

- Multi-factor authentication

- Other data security controls

-

Loss of control over the loan procedure:

Another concern about the offshore team is losing control over the loan process. However, outsourcing firms work closely with their clients to ensure they retain control over critical aspects of the loan procedure.

This includes providing regular updates and reports and involving clients in crucial decision-making processes. Additionally, outsourcing firms typically have dedicated account managers who work closely with their clients to ensure that their needs are met, and their expectations are exceeded.

-

Quality control and compliance issues:

Mortgage brokers ensure that loans are processed accurately and comply with relevant laws and regulations. By outsourcing, a mortgage broker may be concerned that loan assessment procedure quality and compliance may be compromised.

However, firms usually have strict quality control and compliance procedures to ensure that loan options meet industry standards and regulatory requirements. These include regular audits, monitoring and reporting, and ongoing training and development for staff.

Additionally, third-party providers mostly have access to the latest industry knowledge and expertise, which can help brokers ensure that their loan features are of the highest quality and meets all compliance requirements.

How to choose the right outsourcing partner?

Choosing the right partner is vital for mortgage brokers who outsource their loan applications and other mortgage broker tasks. Here are some criteria to consider when selecting an outsourcing firm:

-

Expertise:

You can look for a partner with expertise in the loan-originating process, back-office operations, and experience working with mortgage brokers.

-

Reputation:

Choose a partner with a proven track record of delivering high-quality services and meeting client expectations. You can check customer reviews, testimonials, and case studies showing their industry success.

-

Technology:

Ensure the firm uses advanced technology and software solutions to streamline the necessary paperwork and improve efficiency. Look for partners with experience with the latest loan assessment process software, cloud-based platforms, and other digital tools.

-

Compliance:

Check whether they understand industry regulations and compliance requirements and have procedures to ensure that loan product meets all relevant standards of Australian banks.

-

Security:

You must ensure they have robust security protocols and procedures to protect sensitive client data. Please look for a firm that uses encryption, secure servers, and other security measures to protect client information.

What questions should mortgage brokers ask potential outsourcing partners?

The following questions are designed to assist brokers in addressing their queries and concerns.

- What is your experience working with mortgage brokers?

- What is your approach to quality control and compliance with a bank?

- How do you ensure the security and confidentiality of client data?

- What technology and software solutions do you use to streamline the loan application process?

- How can you communicate with clients and keep them informed throughout the loan application process?

By considering these criteria and asking these questions, mortgage brokers can choose the right third-party provider to meet their needs and achieve their goals.

What are the services provided by Brokers’ BackOffice to a mortgage broker?

Our firm provides a comprehensive range of services to a mortgage broker, including:

- Loan serviceability calculators

- Data entry

- Property valuations

- Loan application

- Loan approval

- Compliance documents

- Mortgage application

- Borrowing power

- Complete loan file

- Discharge form

Conclusion

Outsourcing loan servicing procedures and other back-office activities can benefit mortgage brokers, including increased efficiency, access to expertise and technology, cost savings, and scalability.

As an outsourcing firm specialising in handling loan processing, Brokers’ BackOffice has the experience, reputation, technology, compliance, and security measures to ensure success.

We encourage mortgage brokers to consider external loan processing solutions and explore the possibilities of outsourcing their back-office operations to our team of experienced and reliable professionals.

With the right partner, mortgage brokers can focus on their core functions and drive business growth and success.

Table of contents

Introduction What are the benefits of external loan processing services? What are the common concerns about external service providers? How to choose the right outsourcing partner? What questions should mortgage brokers ask potential outsourcing partners? What are the services provided by Brokers’ BackOffice to a mortgage broker? Conclusion